5 Essential Elements of a Modern Hotel Property Management System

In today’s fast-paced and highly competitive hospitality industry, having a robust Hotel Property Management System (PMS) is no longer a luxury but a necessity. Modern

Payments may appear relatively straightforward for guests, but they can be excruciatingly complex for hotels. The reason for this is that the current payment facilitation landscape is highly distributed: When a guest purchases a room or an add-on and hits “pay,” their request must pass through a series of systems and vendors, including the payment gateway or processors, acquirers and payment service providers, and the various banks and payment methods themselves. The result of this dispersion of vendors is that payments can become needlessly complex for hotels (and their guests!), leading to wasted time, increased errors, and a more cumbersome guest experience. In this article, we’re going to look at ways that hotels can streamline payments, both for their guests and themselves, and in the process develop a secure payments system that can actually enhance revenue and amplify the guest experience.

It goes without saying that hotels should avoid manually processing payments at all costs. Manual payment systems waste time, disrupt the flow of the guest experience and can lead to costly errors and breaches in data security.

But even relying on multiple vendors can be a significant burden on hotels. Multiple vendors mean multiple bills 一 for payment processing, acquiring, schemes, and interchange. This billing structure can become enormously complex, with fees varying depending on the provider, the perceived risk of the merchant, the credit card network, credit card type, transaction details, country-specific regulations, and cross-border transitions. The result is that most hotels wind up paying more than they think they will, and many have no idea how much they are paying at all!

But the burdens from multiple payment vendors do not stop at billing. Multiple vendors mean multiple customer support teams, which offer varying levels of priority support and often do not coordinate with each other to solve payment issues. The result is that while each vendor tries to pass the buck onto another organization, hotels are stuck in the middle trying to find a resolution for their increasingly frustrated customers.

The solution to all of this is to consolidate every aspect of payment facilitation into a single trusted provider that is directly integrated with a hotel’s PMS, payment terminals, and booking engine. This end-to-end solution provides a single point of contact between the guest and their various payment methods while providing hotels with a single transparent bill, and a single contact for direct priority support.

Creating a unified payment process that blends seamlessly into the guest journey can increase conversions 一 and revenue 一 by making it as easy as possible for guests to find and purchase what they want, and ultimately complete the purchasing process. According to a metastudy of 48 abandonment rate studies by the Baymard Institute, approximately 70% of shoppers abandoned their online shopping carts or canceled purchases at checkout. Common reasons include the payment process having too many steps or being too confusing in general, not including their preferred payment method, or not earning their trust (often by redirecting customers to different third-party payment pages). Since paying for a product or service already involves some amount of emotional friction, the key to increasing conversions is to reduce that friction as much as possible

First and foremost, this means that in every way, your payment facilitator should meet your guests where they are. You should be able to accept payments wherever your guests are located, whether it’s in person, through a kiosk in the lobby, or online through their smartphone. You should also be able to accept the types of payment that your guests prefer, whether that involves a credit or debit card, local currency, a digital, or a ‘tap-to-pay’ smartphone. Customized check-out links can also be embedded into an email, text message, or QR code, allowing for more seamless messaging that can blend in with your digital marketing campaign and drive more conversions.

Payment processing should also fit seamlessly with your guest experience. Fully integrated mobile payments is also a necessary capstone to a fully mobile guest welcome or in-stay dining experience. It doesn’t make sense to offer your guests mobile bookings, mobile check-in, offers for amenities and upgrades through their mobile device, and mobile keyless entry, only to force them to pay manually at the front desk.

Online booking and shopping have increased dramatically in the post-pandemic era, and so too has payment fraud. According to JP Morgan, approximately 74% of organizations were the victims of actual or attempted payments fraud in 2020 alone, while in that same year, over 115 million credit and debit card details were stolen and posted on the dark web. Technologies such as one-click payments that are designed to streamline the payment process have also made it harder to detect and prevent fraud, while many common fraud techniques are hard to distinguish from legitimate refunds or chargebacks. The issue is how to deploy systems that can reliably detect and prevent payment fraud without unduly burdening the guest experience.

Dealing with chargebacks can also be difficult for hotels. Chargebacks or payment disputes offer customers a way to dispute suspicious transactions and occur when a cardholder contacts their bank to dispute a transaction (instead of going directly to the merchant). The process for disputing a chargeback can be complex, involving coordination between the card issuer, scheme, acquirer, and merchant. While chargebacks are a normal part of business, they are a potential revenue risk and can create significant headaches for hotels if they are made in error. Hotels can reduce chargebacks by preventing fraud (see our section on data security below), avoiding miscommunications, and making refunds easier. Relying on a single payment facilitator can also help streamline chargeback management, handling, and disputing since more of the chargeback’s steps will take place under the same organization.

It’s critical to find a payment facilitator that offers best-in-class data security. At a minimum, your provider should be PCI DSS and GDPR compliant and have ISO 27001 and SOC2 Type 2 certifications. They should employ additional security features such as regular penetration testing by independent parties, data-at-rest encryption, HTTPS encryption in transit, field-level encryption for sensitive data, comprehensive VPN and firewall or antivirus protection, and active security monitoring and alerting.

They should also leverage advanced AI and machine learning to create nuanced risk profiles to automatically detect fraud attempts and differentiate them from normal consumer behavior. These profiles should include customizable risk rules so that hotels can tailor their risk tolerances to their unique market and customer segments. Finally, it should be stated again that it is more secure to deal with a single trusted provider, rather than multiple vendors with different compliance standards and security protocols. By dealing with a single vendor, you can reduce fraud while also maintaining a streamlined guest experience.

Relying on multiple vendors on the payment backend can lead to a disjointed and complex payment experience for your guests. Hotels need a single, reliable payment facilitator that offers a fully-integrated end-to-end solution in order to deliver a payment experience that is unified, streamlined, secure, and profitable.

In today’s fast-paced and highly competitive hospitality industry, having a robust Hotel Property Management System (PMS) is no longer a luxury but a necessity. Modern

Harnessing the Cloud PMS & Revenue Management Advantage! The modern hotelier is not only expected to deliver an exceptional service but also have to have

Meet Stjepan Štajduhar, the innovative designer behind Stayntouch PMS. We sat down with Stjepan Štajduhar, our Lead Product Designer, as he reveals the design secrets

Since the start of the pandemic, hotels have been caught in a COVID Catch-22: They are expected to deliver enhanced service, cleanliness and personalization, with

HITEC Amsterdam 2018 is nearly upon us! Based on the success of last year’s inaugural show, HITEC Amsterdam is back and will run from April

This week sees Apple launch a series of new phones, the iPhone 8, 8+ and X, the latter aptly named on this its 10th anniversary

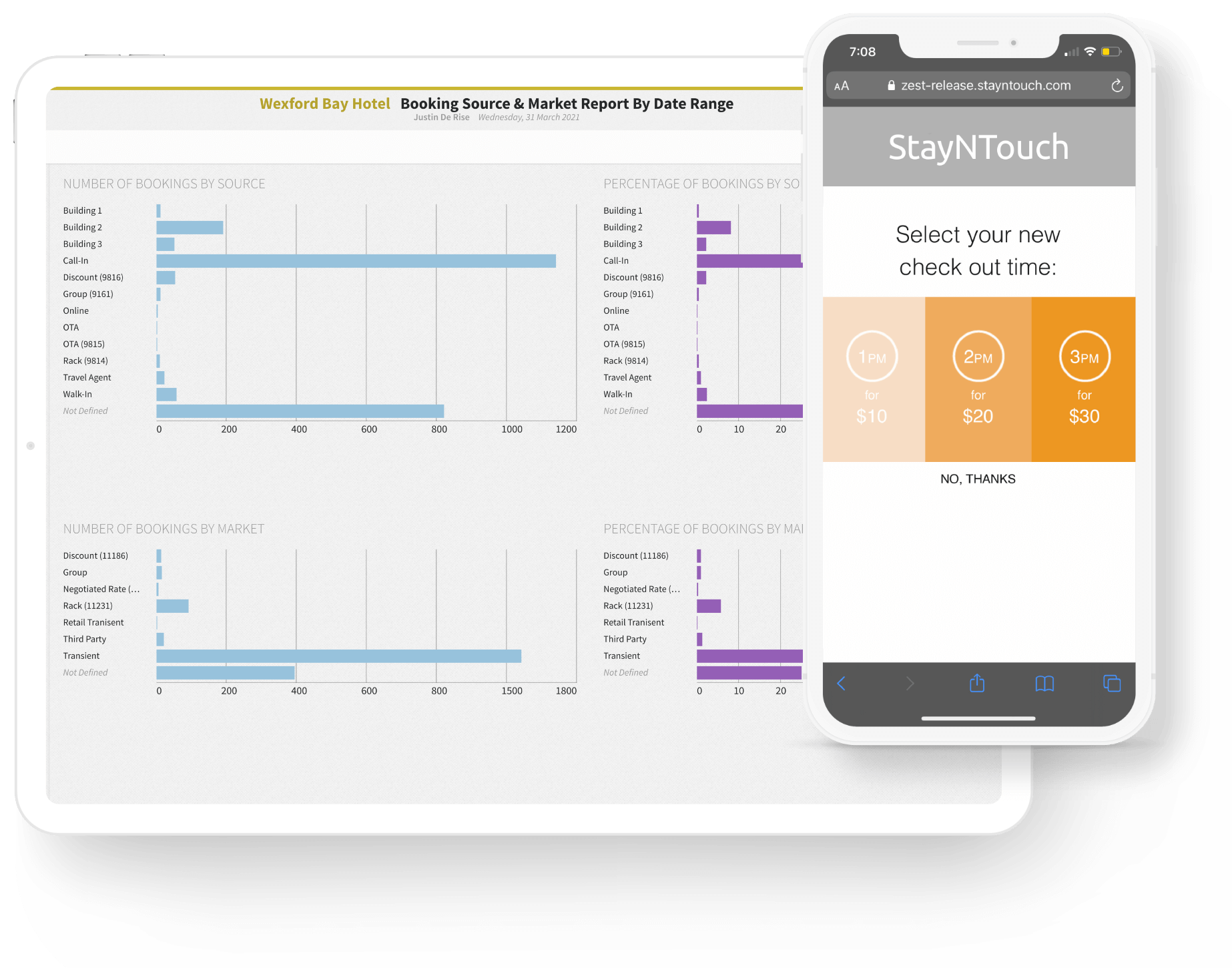

See how StayNtouch’s Cloud PMS, Guest Mobility, and Guest Kiosk solutions deliver better results for hotels through better front & back of house communication, increased mobile touch-points, more revenue and operational efficiency, and unlimited interfaces.

Your demo will include how to:

Manage and Set Tasks Across Your Departments

Ensure Guest Satisfaction & Safety With Contactless Check-in Options

Automate Easy Upsells & Monetized Early/Late Checkouts

Set & Manage Rates/Availability

Integrate With Tools and Platforms Essential

to Your Hotel

And More!